Award-winning PDF software

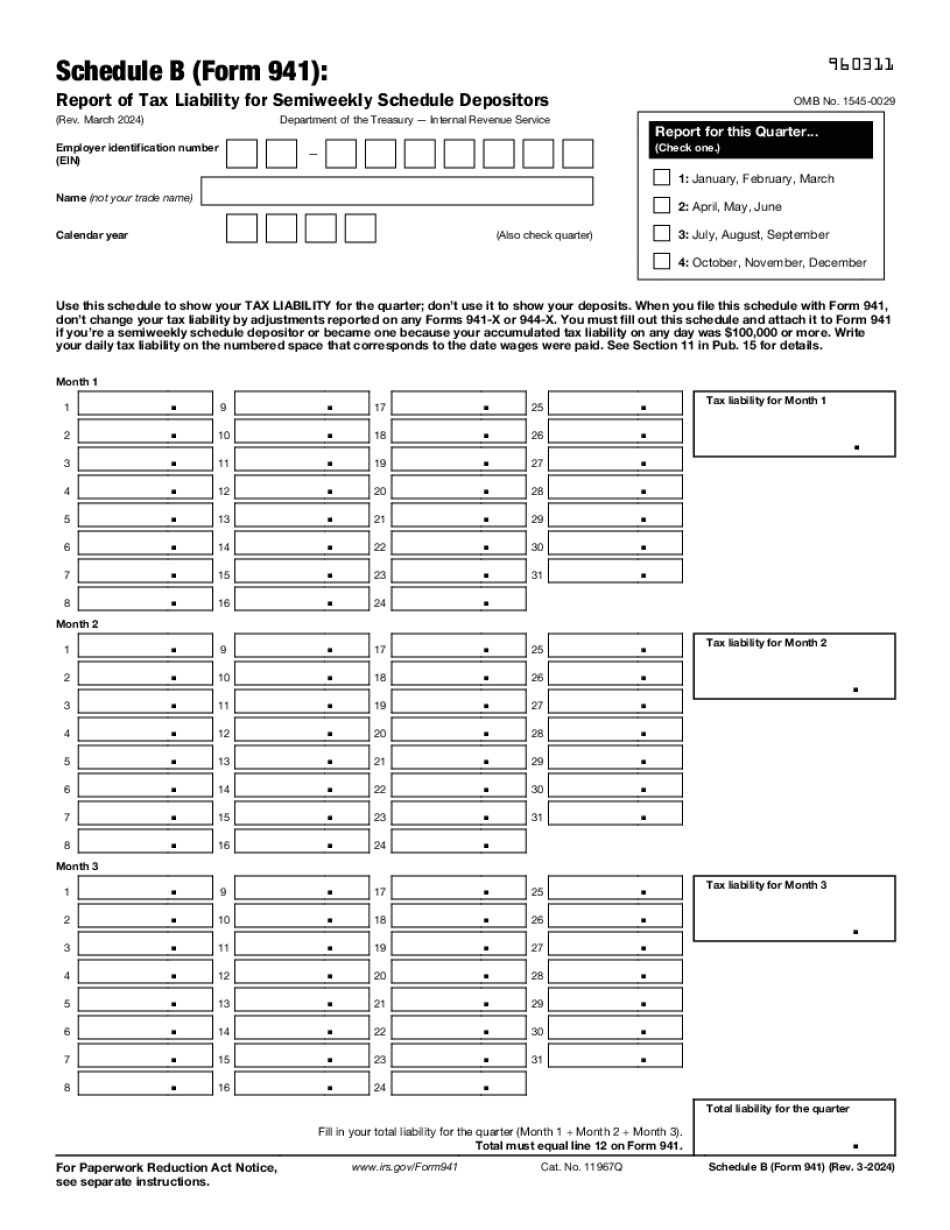

Form 941 (Schedule B) for Murrieta California: What You Should Know

I don't own an office in Murrieta. I just have a home office here in San Luis Obispo. (If you are in Southern California, and if this letter appeals to you, we would be happy to discuss the tax issue with you). Let me give you some guidance on the form. First, please do not file this form alone. You need to know the address of the business. We have two locations for our firm: a home office and an office. When we handle business from the office, we file this Form 941 at our home office. When we handle business from home or our office, we file this form at the office where we do business. We must keep this form and all the documents filed in it updated on the internet. If you are unsure of an address for our firm, try to contact our office and see if we have a form in our office file. (If you are still unsure, you can contact the Murrieta office, but they will have to tell you when they started operations here). Let me break it down for you. First, we file this form at the home office or office where we do business. Secondly, we are required to keep a copy of the Form 941 in the office. As we have a copy, we are required to update the address and all the other pages on the paper form. There is nothing about the Form 941 being “required to be updated” at the office (although the office owner is required to file this same form, so they will have to update it as well). When you file this form with the IRS, you enter your business name and business address, if you have any. We try to keep the address accurate because then we aren't required to file this form, and the bank does not require it (and then the bank will only charge you the transaction fee). All you need to do is fill out the appropriate fields and check the “Yes” and “No” boxes to confirm each item and the amount you owe. The tax due will be shown on your final return for the year. You must show both the original Form 941 and any corresponding paper form or electronic statement made to you from the IRS or from your bank. The IRS only accepts a return filed on the same day.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941 (Schedule B) for Murrieta California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941 (Schedule B) for Murrieta California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941 (Schedule B) for Murrieta California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941 (Schedule B) for Murrieta California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.