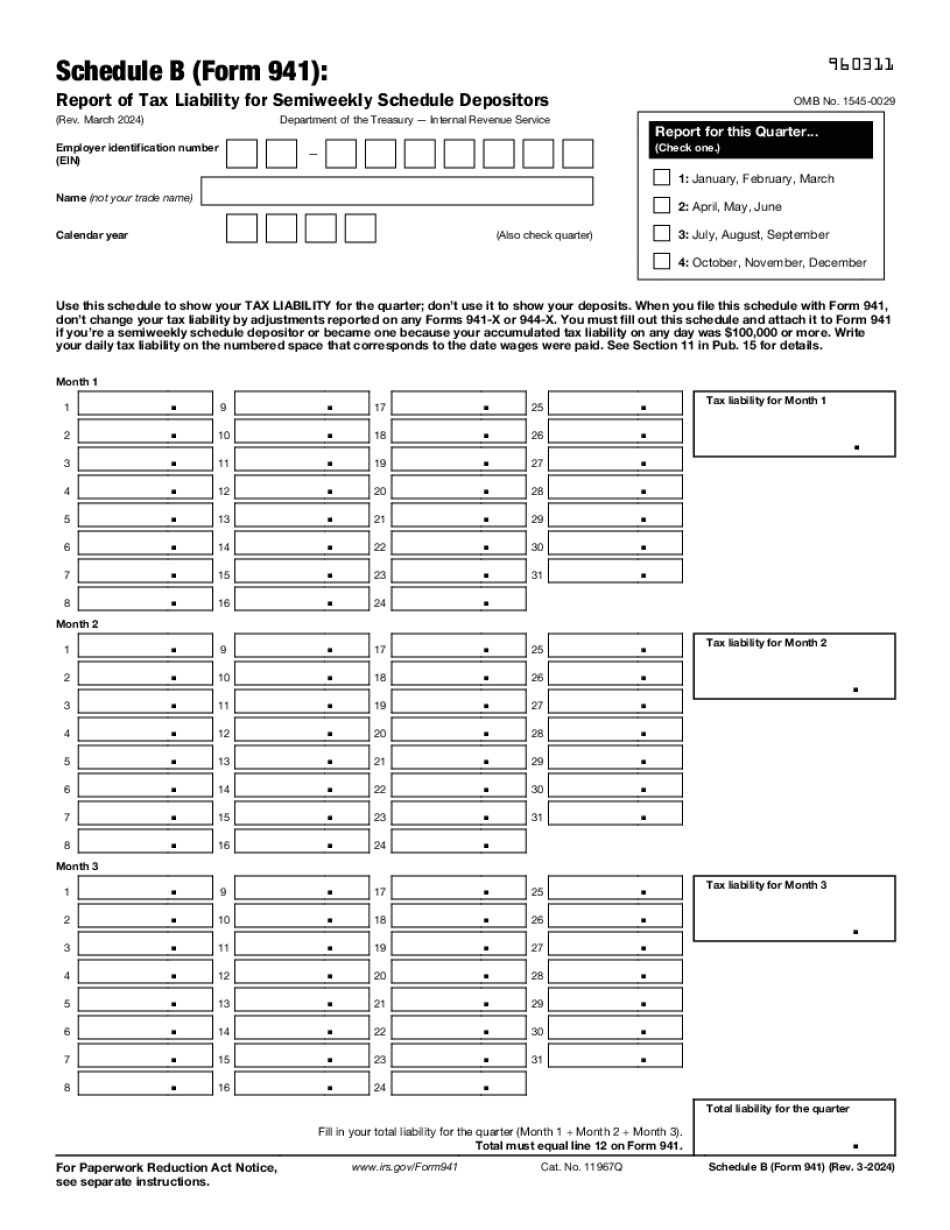

This video is how to prepare Schedule B of the 941 if you remember from the last video on page 2 of the 941 part 2 we have to mark whether we are a monthly or a semi-weekly depositor if we are a semi-weekly depositor then we must get a touch Schedule B and that's what this video is going to demonstrate for the demonstration I am using the information given in problem 3 – 15 an on page 3 – 48 of your textbook I have that information in an Excel document, so this is the information that was provided by your textbook and then for requirement a PRE preparing the Schedule B and I need to do some calculations before I could do that form. I have added those calculations down below here so trading the liability or calculating the liability for each one of the payrolls is done by looking at the employees FICA withholding the OAS DI portion which comes from here and then the employers portion which is calculated by taking the taxable wages times the percentage which is the same amount in this case they do not always come out to be identical but in this case they do. And then the employees FICA the Jaipur sin which comes from here in the employers portion which again is the TeXes wages times the percent 1.45%, and it happens to match the employees withholding for that period in this case. And then the employees federal income tax withholding which came from here we add that all together and the liability for that date was six thousand nine hundred and thirty-three dollars and fifty cents that took place on January 15th so in the first month on our form on the fifteenth day we would place...

PDF editing your way

Complete or edit your form 941 schedule b anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 941 schedule b directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 941 b form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 941 internal revenue by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 941 (Schedule B)

What Is 941 Schedule B 2020?

Online solutions help you to organize your document management and boost the productiveness of your workflow. Look through the short manual so that you can fill out Irs 941 Schedule B 2020, stay away from errors and furnish it in a timely way:

How to complete a schedule b?

-

On the website with the form, click Start Now and pass for the editor.

-

Use the clues to fill out the suitable fields.

-

Include your individual data and contact details.

-

Make absolutely sure that you choose to enter appropriate information and numbers in proper fields.

-

Carefully verify the content in the document so as grammar and spelling.

-

Refer to Help section in case you have any concerns or address our Support staff.

-

Put an electronic signature on the 941 Schedule B 2025 printable while using the support of Sign Tool.

-

Once document is completed, click Done.

-

Distribute the ready by way of electronic mail or fax, print it out or save on your device.

PDF editor makes it possible for you to make changes on your 941 Schedule B 2025 Fill Online from any internet connected device, customize it in keeping with your needs, sign it electronically and distribute in different means.

What people say about us

Filing electronically templates from your home - important ideas

Video instructions and help with filling out and completing Form 941 (Schedule B)