Award-winning PDF software

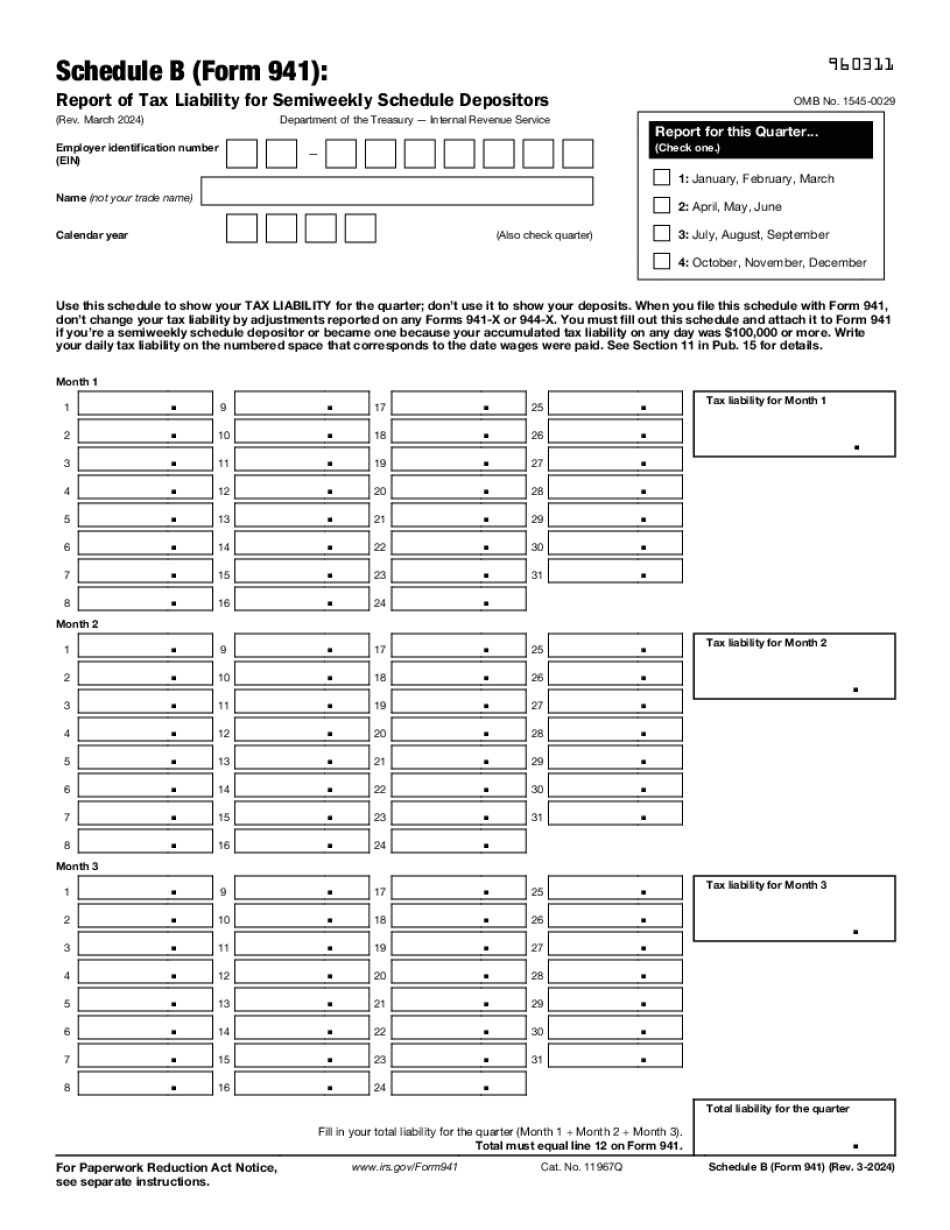

South Dakota Form 941 (Schedule B): What You Should Know

IRS announces new tax forms for 2025 — This is a reminder that North Dakota has a special filing and assessment code for individuals age 65+ and the elderly The tax period for the 2025 tax year runs from April 1, 2015, through the date on which the taxpayer dies. The individual's custody is considered to begin when both the individual and the individual's attorney have signed the death warrant. Tax Filing Date Deadline You are required to file your return and notify the IRS of your return information no later than the filing date for the year covered by your return. If you cannot file your return by the due date for your return, but you must file more than one return, you must file your return(s) at the time you would file the returns with the proper return instructions if you have not already completed a second return. The State Treasurer's Office is responsible for the administration of tax, including the collection of federal and state income taxes, of the state of North Dakota, and the United States of America. Tax Filing & Assessment Deadline To verify your personal information and obtain a copy of your federal tax return and other tax information, call or contact an IRS Enrollment Specialist. Taxpayers should refer to the North Dakota Revenue Practices Code (DRC) and the Internal Revenue Manual (IRM) to report the information that they have to report on their income tax return. Taxpayers should refer to the North Dakota Department of Revenue “Tax Information Guide” for income tax information for individuals and businesses, for details on preparing and filing your tax return to the federal level, from the North Dakota Department of Revenue website, and for a copy of the DRC. The DRC is available in both English and Spanish. The complete DRC is available on this website. Other Important Tax Topics To learn about other tax issues for North Dakota, including the sales and use tax, contact the North Dakota State Revenue Practices Division at or visit their website. There are laws that require you to pay the appropriate North Dakota sales tax, or you could face penalties.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete South Dakota Form 941 (Schedule B), keep away from glitches and furnish it inside a timely method:

How to complete a South Dakota Form 941 (Schedule B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your South Dakota Form 941 (Schedule B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your South Dakota Form 941 (Schedule B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.