Award-winning PDF software

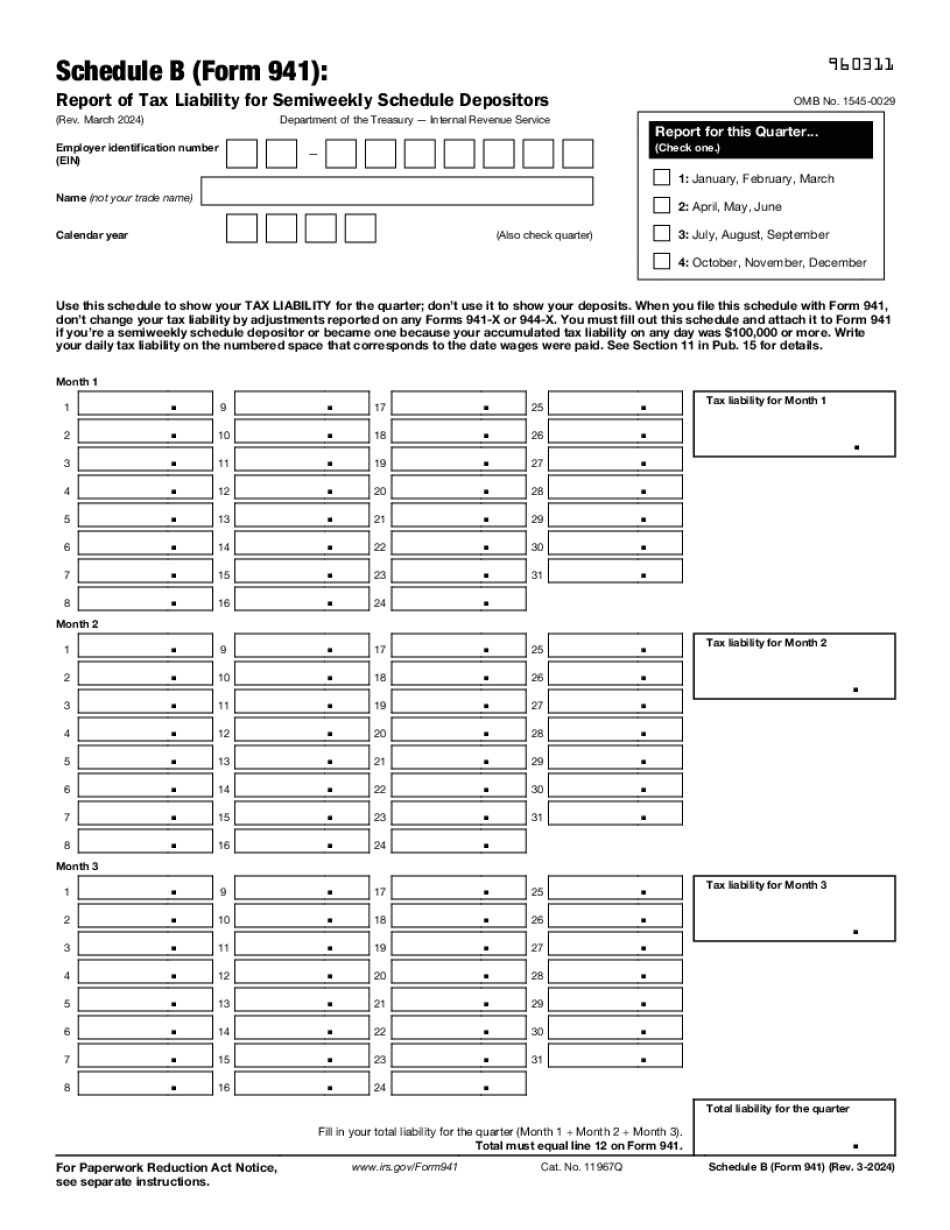

Mesa Arizona Form 941 (Schedule B): What You Should Know

Arizona Business Owners Tax Information Tool See below the links for the Arizona BOT (Business owners tax) information tool. Form 954 BOT — Form 954 For Business Entities and Corporations. AZ-BSIT-EZ-2.pdf BOT (Business owners tax) information tool (PDF files). Arizona Certificate of Authority (COA) Requirements All businesses required to file a Certificate of Authority must comply with the requirement that the certificate be completed and signed by its owner and an Arizona Department of Business Services (DBS) official. A Certificate of Authority (COA) may not be used for any purpose other than to demonstrate the existence of an approved Arizona company which is not a qualified employer with regard to the Arizona Unemployment Insurance (AUI) Act. An Arizona Certificate of Authority includes one of the following components: • A certification by the employer that the entity has filed an Application for Certificate of Authority with the Arizona Department of Business Services, with the name of both the person authorized to sign as the owner, and the person authorized as the agent. (Form BZ-1, Business Registration.) The Arizona Department of Business Services will verify that the applicant is authorized to sign as the owner and agent, as well as to conduct business in the manner required. • A certification that the entity satisfies the requirements for registration, including, subject to the limitations on certain tax withholding requirements, filing the appropriate federal and Arizona returns. • A certification that the entity has executed an Annual Report to the Arizona Department of Business Services which shows the following information: • The name of the entity. • The number of stock shares owned. • The aggregate dollar amount of the taxable gross receipts. • The gross receipts reported as employment income under the federal Internal Revenue Code and the gross receipts reported as business income under this Code when they are received from a qualified Arizona business as a direct disbursement or a transfer of property; from a bona fide private activity (BSA) which is not a retail trade, business, or occupation; or from a qualified Arizona farm. The gross receipts reported under the BSA and BRAIN test, together with the gross receipts reported under the other two tests, will be used in the computation of the business gross receipts as provided under the federal Internal Revenue Code. • A list of all qualified entities listed on both the Certificate of Authority and on their federal tax returns.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Mesa Arizona Form 941 (Schedule B), keep away from glitches and furnish it inside a timely method:

How to complete a Mesa Arizona Form 941 (Schedule B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Mesa Arizona Form 941 (Schedule B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Mesa Arizona Form 941 (Schedule B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.