Award-winning PDF software

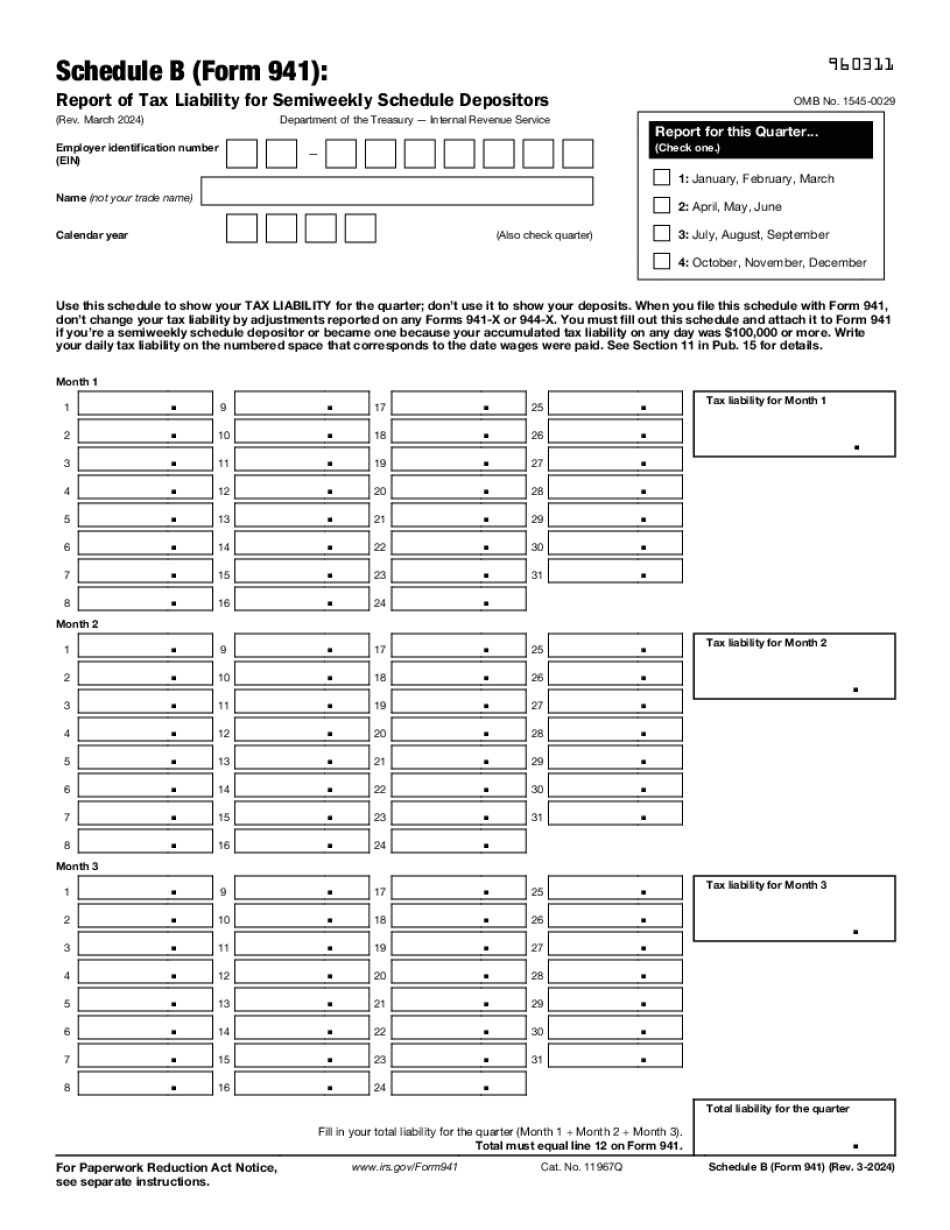

Form 941 (Schedule B) online Colorado Springs Colorado: What You Should Know

Form 941 Filing CALIFORNIA — California Limited Liability Companies Filing of Form 941 (Rev. June 2022) — IRS Forms: 1099-SA, Form 1099-INT, 1099-MISC, 844-HT IF YOU HAVE A CLOSED BUSINESS OR ARE NOT A FORM 941 FIDUCIARY, PLEASE DUE DATE IS THE 1ST QUARTER OF THE YEAR, BEFORE PAYMENT DATE FOR THE NEXT QUARTER, AND PAYMENT CANNOT BE REFUNDED ONCE IT IS FILED! If you have a Listed Limited Liability Company OR Any Small Business Corporation OR A Joint Venture Company PLEASE REQUEST FOR A FORM 941 ETA STATEMENT AND S.K.I.T. ASSESSMENT BY. AND THE S.K.I.T. ASSESSMENT WILL Be assessed YOUR FINANCIAL STATUS, PROPERTY, AND ASSET VALUE DURING THIS TAX YEAR For the fiscal years ending June 30, 2018, October 31, 2017, and June 30, 2018, we will issue a Form 944 showing the value of assets recorded in our inventory as of June 30, 2018. We will issue a Form 944-S for the first quarter ending September 30, 2018, and a Form 944-S for the second quarter ending March 31, 2019. If your business was incorporated after June 9, 1994, we will provide a Form 4023 with a balance due date of February 14, 2019. For all other businesses we will issue a Form 4023 or a Form 4024. If you are a company that is seeking to establish an R&D Center, the business must file a UCC851 if it is for the period after October 1, 2016. A UCC851 will be filed if the business has been selling and accepting orders for five years or less. If your business is a sole proprietorship, corporation, partnership, or an estate, the UCC851 is a Form 853 and the filing fee for the UCC851 is 100.00 for each quarter before the Form 853 is filed. If you are a sole proprietorship, we will file a UCC1T with the IRS as it is called if you have been operating as a sole proprietor since January 1, 1994.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941 (Schedule B) online Colorado Springs Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941 (Schedule B) online Colorado Springs Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941 (Schedule B) online Colorado Springs Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941 (Schedule B) online Colorado Springs Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.