Award-winning PDF software

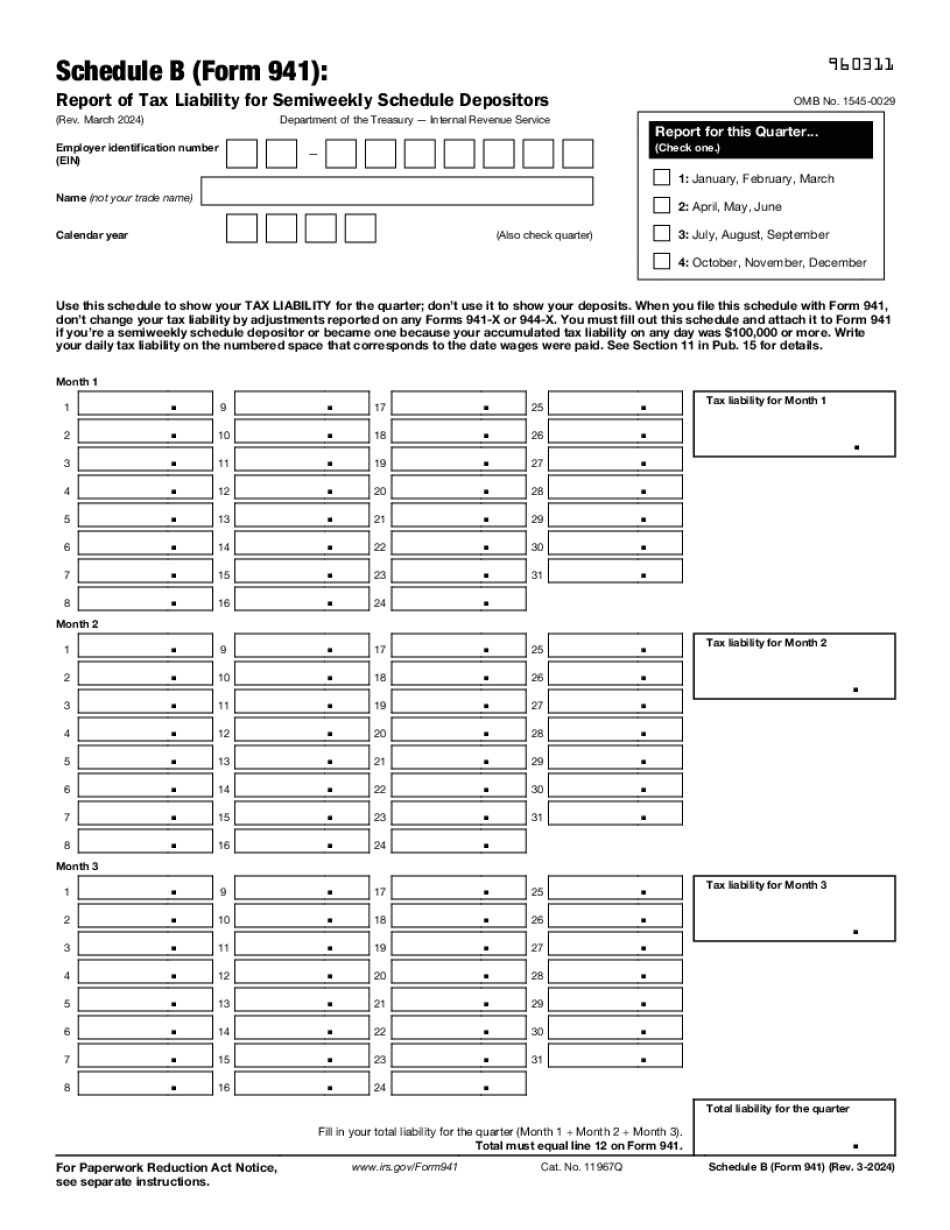

Form 941 (Schedule B) Irvine California: What You Should Know

Learn about Form 941 — IRS Form 941 (PR Form 941), and Form 944 Tax Rates for Quarter 1, Quarter 2, etc. Use this table to help you determine the tax rate for your business for the quarter. The tax rates below refer to your company's business income, not net earnings. You can use this table to help identify any tax increases or decreases that you need to include. Quarter 1 – Jan 1, 2025 – Dec 31, 2017 Quarter 2 – Feb 1, 2025 – Dec 31, 2018 Quarter 3 – Mar 1, 2025 – Dec 31, 2019 Quarter 4 (May 1, 2025 – Jan 31, 2019) Quarter 5 (June 1, 2025 – Feb 31, 2019) Quarter 6 (July 1, 2025 – Mar 31, 2019) Quarter 7 (Apr 1, 2025 – Apr 30, 2019) Quarter 8 (May 1, 2025 – May 30, 2019) Quarter 9 (Jun 1, 2025 – Jul 31, 2019) Quarter 10 (Jul 1, 2025 – Aug 31, 2019) Quarter 11 (Aug 1, 2025 – Sep 30, 2019) Quarter 12 (Oct 1, 2025 – Oct 31, 2019) Quarter 13 (Nov 1, 2025 – Nov 30, 2019) Quarter 14 (Dec 1, 2025 – Dec 31, 2019) Tax Rate The tax rate used for your taxable income is the same as your business's average tax rate — that is to say, the tax rate that your business pays on your average revenue. The average tax rate is a measure of the tax rate on your average revenue and is a result of the following factors: Taxable Income: The total amount of taxable income for your company is the amount of money you earn from the sale of your company's products and services plus the amount of taxable income from all investments and/or rental of space, and all business profits plus interest, dividends, and royalties. Net Earnings: This is the amount of money you earn after paying for such expenses as employee salaries, rent, and business improvements. Taxable income is computed based on the profit or loss of each business operation. Estimated tax due: The estimated tax due for your business is the amount of taxes you expect to owe for the current year, less any estimated taxes you have paid in the current year before filing your return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941 (Schedule B) Irvine California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941 (Schedule B) Irvine California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941 (Schedule B) Irvine California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941 (Schedule B) Irvine California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.