Award-winning PDF software

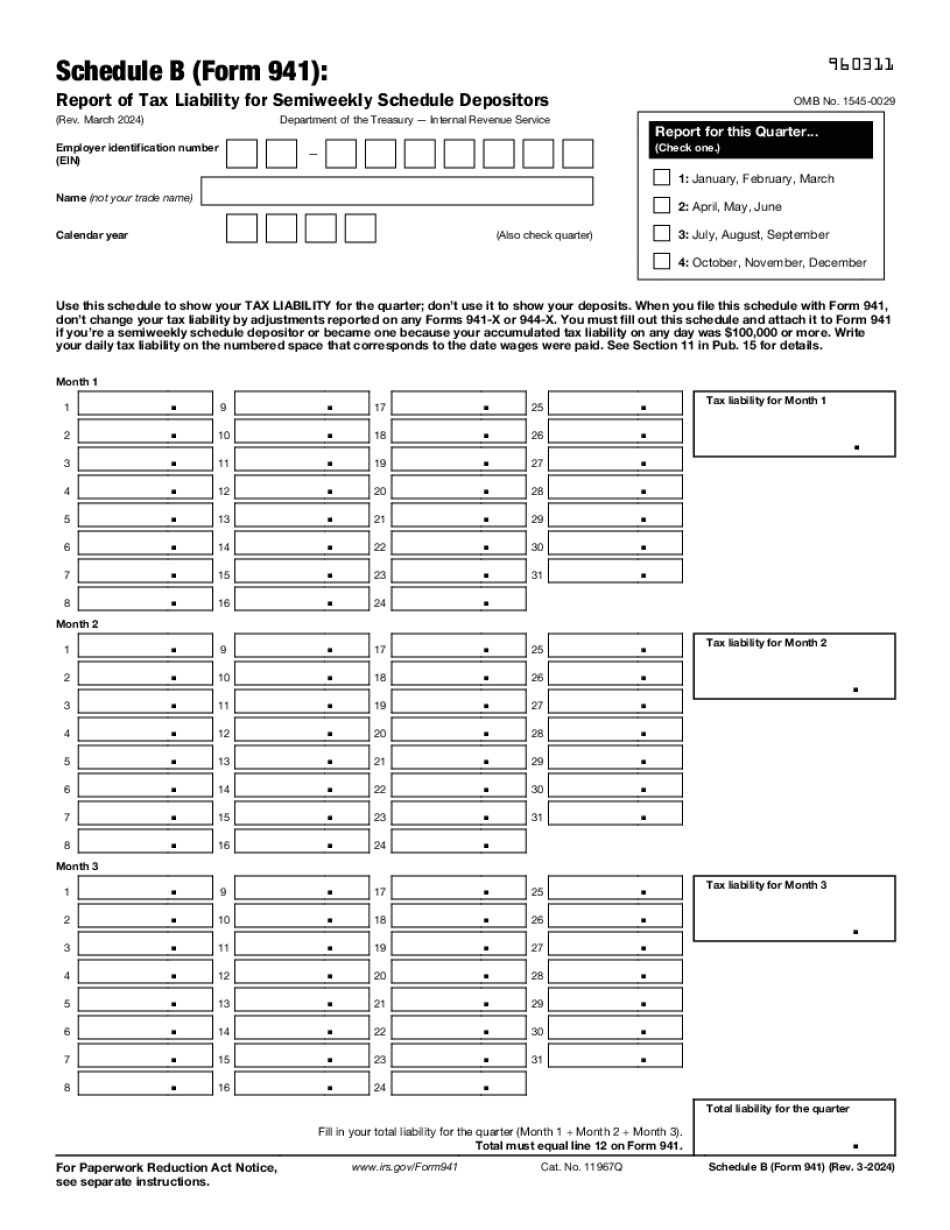

Form 941 (Schedule B) for Vacaville California: What You Should Know

How to File Schedule B for Form 941 — Wage point Blog Sep 12, 2560 BE — The IRS issued final instructions for Form 941 (Employer's Quarterly Federal Tax Return), Schedule B — Schedule Depositors, with new information that must be filed How to File Schedule B — Schedule Depositor — Wage point Blog Additional Form 941 and 941-S to be filed Instructions for Schedule B — Schedule Depositor for Semi-weekly Schedule Depositors — Filling the form, completing forms, and sending them to the IRS Instructions for Form 941-C for Qualified Business and Qualified Small Business shareholders — Pay off a loan. The IRS is accepting a few Forms 941-C for online filing, you can use them to pay off a loan. You can apply to be paid by check. Instructions The IRS is releasing new information for Form 3911, Form 2958, Form 5498A and Form 5498E which are forms that provide information about a taxpayer's U.S. source income. The IRS is preparing to issue a notice on March 31 (or early March 15) to remind taxpayers of these forms. Here are the details about these forms. Taxable interest income is the capital gain or loss on the sale or exchange if the taxpayer's modified adjusted gross income (MAGI) is more than the poverty guidelines level for your tax filing status, or for your filing status in the last tax year. Taxable interest income does not include tax-exempt interest or investment interest. Dividends are interest or dividend income received by a corporation, which is distributed to its shareholders. Such dividends will usually qualify as ordinary income under the rules for capital gains. Dividends may also be regarded as eligible, nondeductible interest income when paid to a United States citizen or resident for his or her services as a government employee. Taxpayers may also be able to deduct capital losses incurred during the taxable year that reduced their taxable income for the preceding taxable year, provided he or she had not sufficient basis for the losses. Capital losses do not always have to be carried over for future years. Qualified Business and Qualified Small Business shareholders are people/companies (including partnerships and S corporations) who have elected to treat their ordinary income and losses for the year as small business tax credits and deductions, instead of as ordinary income and losses.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941 (Schedule B) for Vacaville California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941 (Schedule B) for Vacaville California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941 (Schedule B) for Vacaville California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941 (Schedule B) for Vacaville California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.