Award-winning PDF software

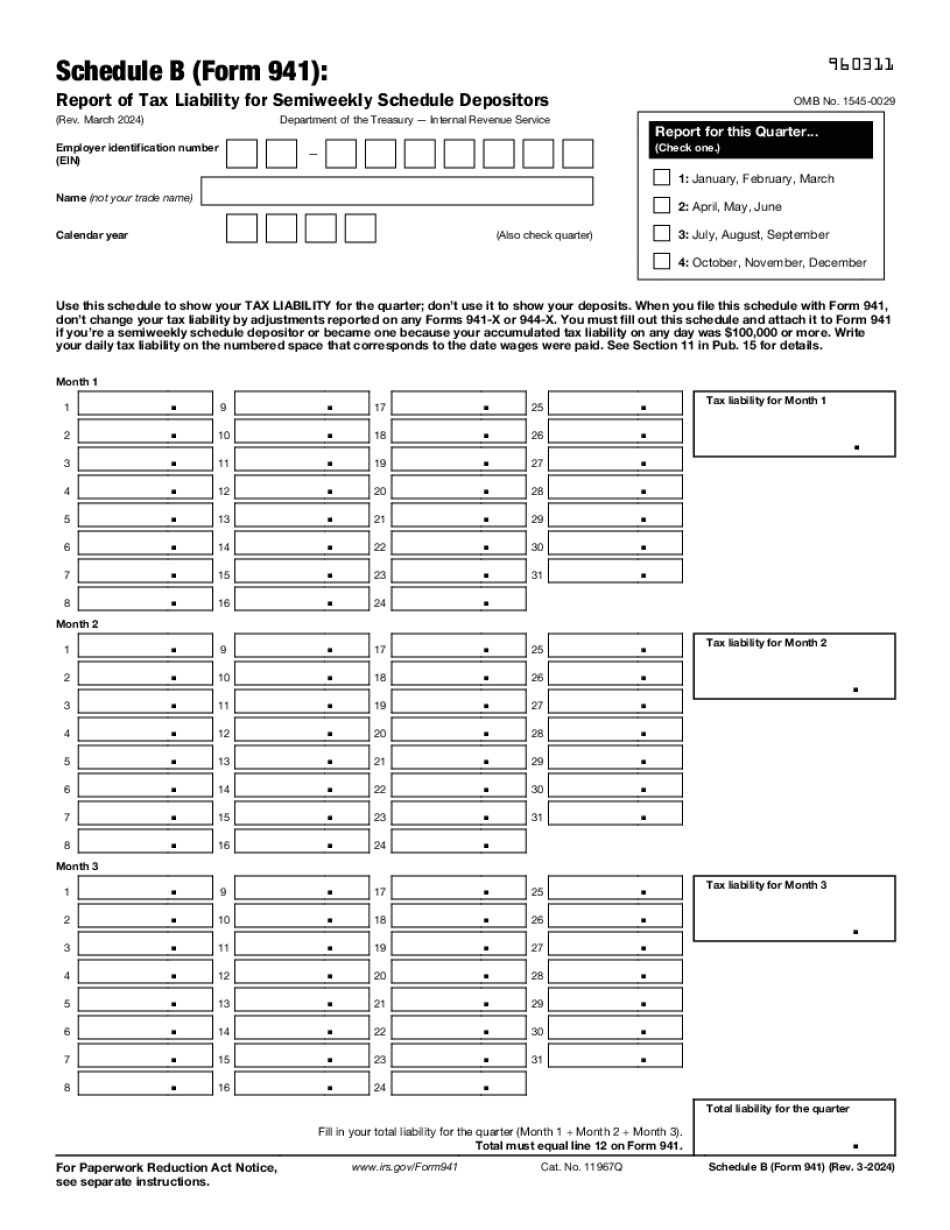

MI Form 941 (Schedule B): What You Should Know

P-931 Information for New Taxpayers. Michigan's Income Statement and Tax Information Forms (for 2025 taxable years) | MRS (Click Here) (instructions for 2025 Form 8888). City of Pontiac. Income and Property Tax Statements | P-931 (2 Pages), (2016) Payroll Departments Tax Returns. Income Tax: City of Pontiac Tax Forms. (updated for 2025 and 2017, click here) (Rev. 2017) The City of Pontiac may have multiple taxes to calculate your liability. In this case, use the income tax forms and information from MRS to determine your liability for each tax. Property Tax Information on the City's Website | MLive.com (updated 2017) (click here) The City of Pontiac may have multiple property tax rates and forms. In this case, use the information and forms on MRS to determine your liability for each property tax. The City of Pontiac offers two tax filing services: One-time property tax preparation — Use this quick link to find out how to prepare the necessary tax documents for tax year 2025 and 2018. Online Property Tax Forms and Rates | MLive.com (updated November 27, 2015). Tax Forms and Rates | MLive.com (updated November 27, 2015) (click here) The city uses a schedule to complete the one-time preparation of property tax and income tax. It's a two-party agreement between the city and the taxpayer: The Tax Department: Provides the tax return and schedules the forms you will need The Private Taxpayer: Provides payment for the property tax and income tax. The City of Pontiac's property tax liability is the total of these two parties' combined liability. If the City of Pontiac doesn't agree this is their total property tax liability, then the private taxpayer's total property tax liability is only that number, so if you are in contract dispute with the city, try filing an appeal or filing a dispute. The reason the city uses the two-party agreement is so both sides share responsibility for paying taxes on all the property in their jurisdiction. After completing the forms and payments, you will be asked to mail or fax a payment receipt at your nearest post office box for filing. Fax that receipt, along with a copy of your property tax and income tax forms to: Tax Dept.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete MI Form 941 (Schedule B), keep away from glitches and furnish it inside a timely method:

How to complete a MI Form 941 (Schedule B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your MI Form 941 (Schedule B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your MI Form 941 (Schedule B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.