Award-winning PDF software

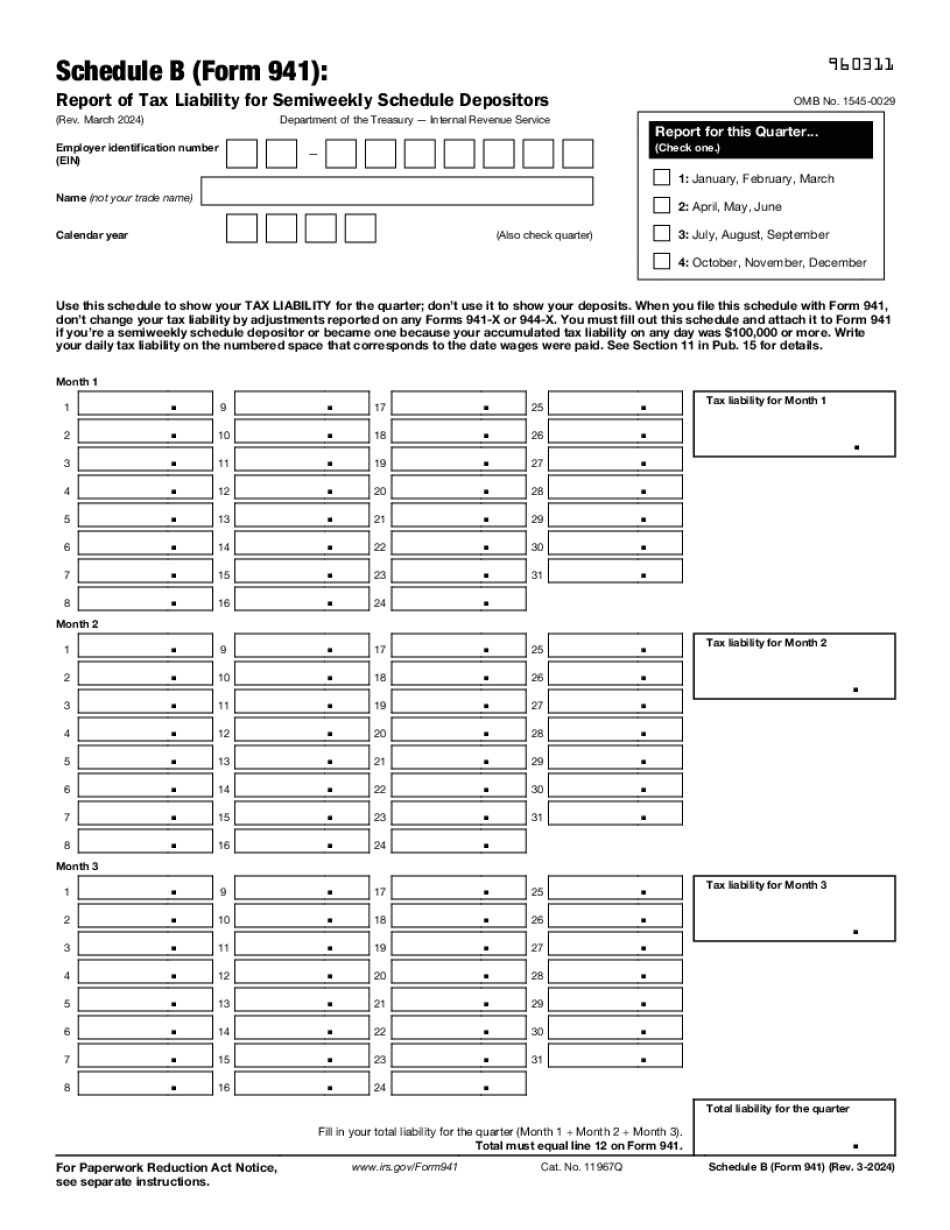

CO online Form 941 (Schedule B): What You Should Know

Form 941, the “Alternative Minimum Tax,” was enacted as a way to raise revenue and to discourage high-income filers from avoiding taxes. According to the nonpartisan Tax Policy Center, the tax imposed by the AMT has not a major effect on the amount of taxes that high-income people have to pay. It was adopted in 1969, and it applies to filers who made more than 50,000 in taxable income in each of two years. The tax does not apply to individuals who file joint returns. When the AMT was enacted, there were relatively few taxpayers filing returns claiming a deduction for the alternative minimum tax; today there are nearly 5 million taxpayers claiming the tax.[1] However, the tax has become extremely popular in recent years, because it reduces an individual's tax liability at the beginning of a tax year to the amount of the standard deduction and 6,350 for joint filers. Taxpayers who itemize deductions, also called itemizes, can reduce the amount that they pay in taxes by taking a deduction for the AMT. The tax also has become controversial because there are no limits on the type of personal exemptions and personal deductions that an individual can claim. In addition to the tax bill, the law also imposed other changes on the economy, including a 1.4% tax on investments by individuals with an annual income of more than 200,000, and the repeal of the estate tax. This legislation included no changes for businesses. On Feb. 14, 2017, the House voted, 228 – 195, to repeal the estate tax. The Senate was unable to achieve a similar result on March 23.[2] Form 941 for 2017 The main purpose of form 941 is to calculate your taxable income and liability for the next year. The amount of liability you report must be the same or as close as possible to the amount of income you have reported for the preceding tax year. You also report what you owe the IRS and what your dependents pay. The form is also used to calculate the alternative minimum tax (AMT) if you did not file the returns. You also use the form to file your 2025 tax return as well as other tax-related documents. The deadline for filing your 2025 tax return is April 18.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete CO online Form 941 (Schedule B), keep away from glitches and furnish it inside a timely method:

How to complete a CO online Form 941 (Schedule B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your CO online Form 941 (Schedule B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your CO online Form 941 (Schedule B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.