Award-winning PDF software

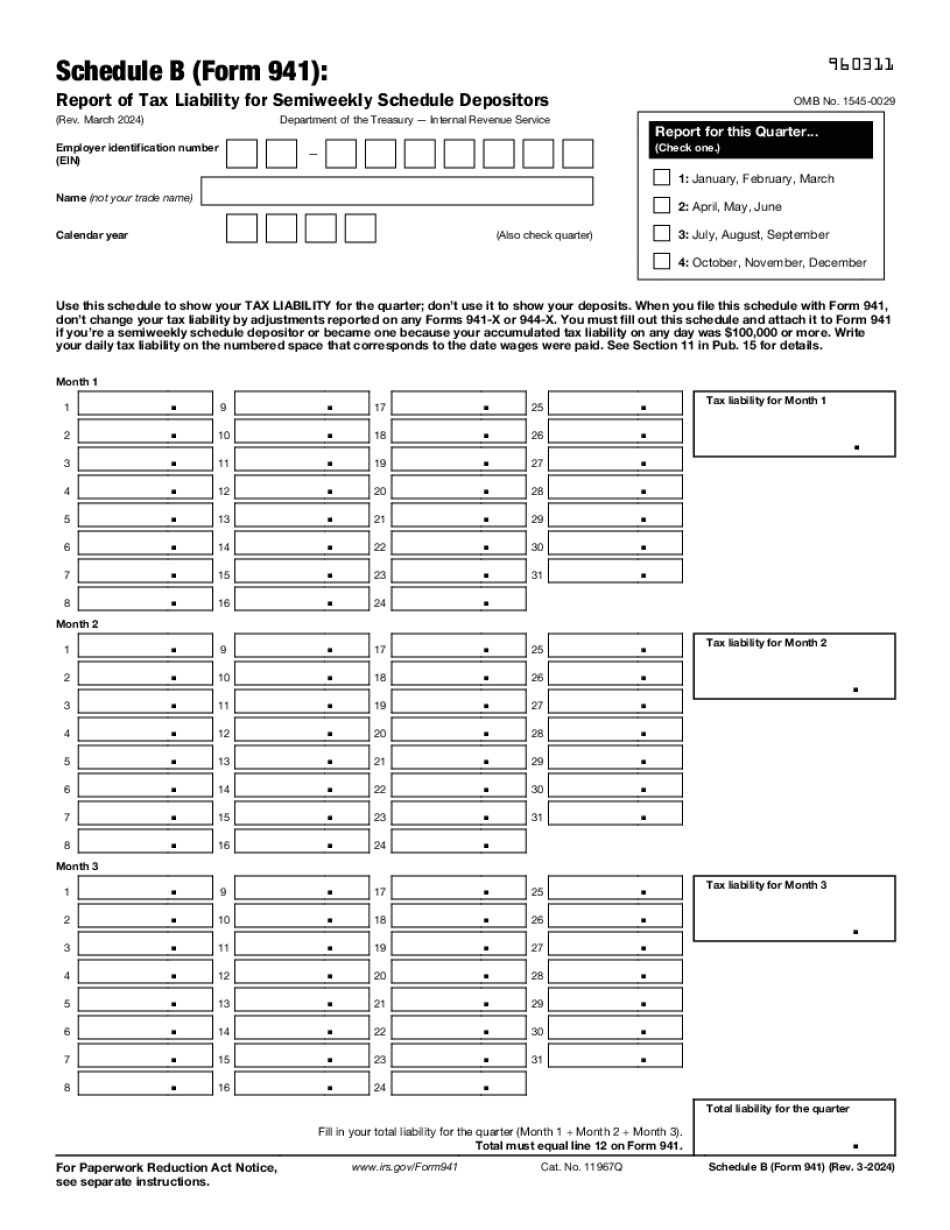

Printable Form 941 (Schedule B) Long Beach California: What You Should Know

Proof of current residency in Long Beach •. A copy of a current utility bill (not the bill associated with the application). City of Long Beach — Tax Collector The IRS forms FT 3033(a), FT 3033(b), FT 3056, FT 4400, FT 4432, FT 4433 and FT 4434 must be completed and presented to the Tax Collector with the other forms. They are available in the Tax Collector's office and online in the following formats: For more information, see Forms and Publication 946, Tax Withholding and Estimated Tax. 2022 Instructions for Form 540 Personal Income Tax The following information must meet all requirements of the form. Complete, sign, date and stamp the entire form. If necessary, mail it to the County Clerk's Office 2024 Long Beach County Assessor's Certificate The County Assessor for the County of Long Beach should provide the following documents: •. Assessor's Certificate in paper format. It can be faxed to. •. Certificate of Assessor's Address. •. Certificate of Assessor's Fax Number. •. Certificate of Assessor's Telephone Number. •. Certificate of Assessor's E-Mail Account. 2025 City of Long Beach Tax Collector The Long Beach County Assessor's Certificate should be provided. 2026 Long Beach State Board of Equalization 2027 Long Beach County Assessor Note that if there will be additional property tax levied by a City for such purposes, then it will not be assessed against the property until the assessment has been completed. 2028 Long Beach County Assessor Assessments against property by a local taxing authority are exempt from the tax rates set forth in Article IV, Section 13 of the California Government Code. 2029 Long Beach County Assessor The California Government Code provides that the Assessor is required to provide the Tax Collector with a copy of the latest Assessor's Statement of Assessment form, when it has become available, and every six months thereafter. As you are required to report your income and property taxes, it is your obligation to provide the latest Assessor's Statement for review as required by law. NOTE ON CHANNELS/CALLINGS: The following channels/calls are not required on this tax form, and, if you prefer the use of channel calls, you are welcome to do so.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 941 (Schedule B) Long Beach California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 941 (Schedule B) Long Beach California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 941 (Schedule B) Long Beach California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 941 (Schedule B) Long Beach California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.