Award-winning PDF software

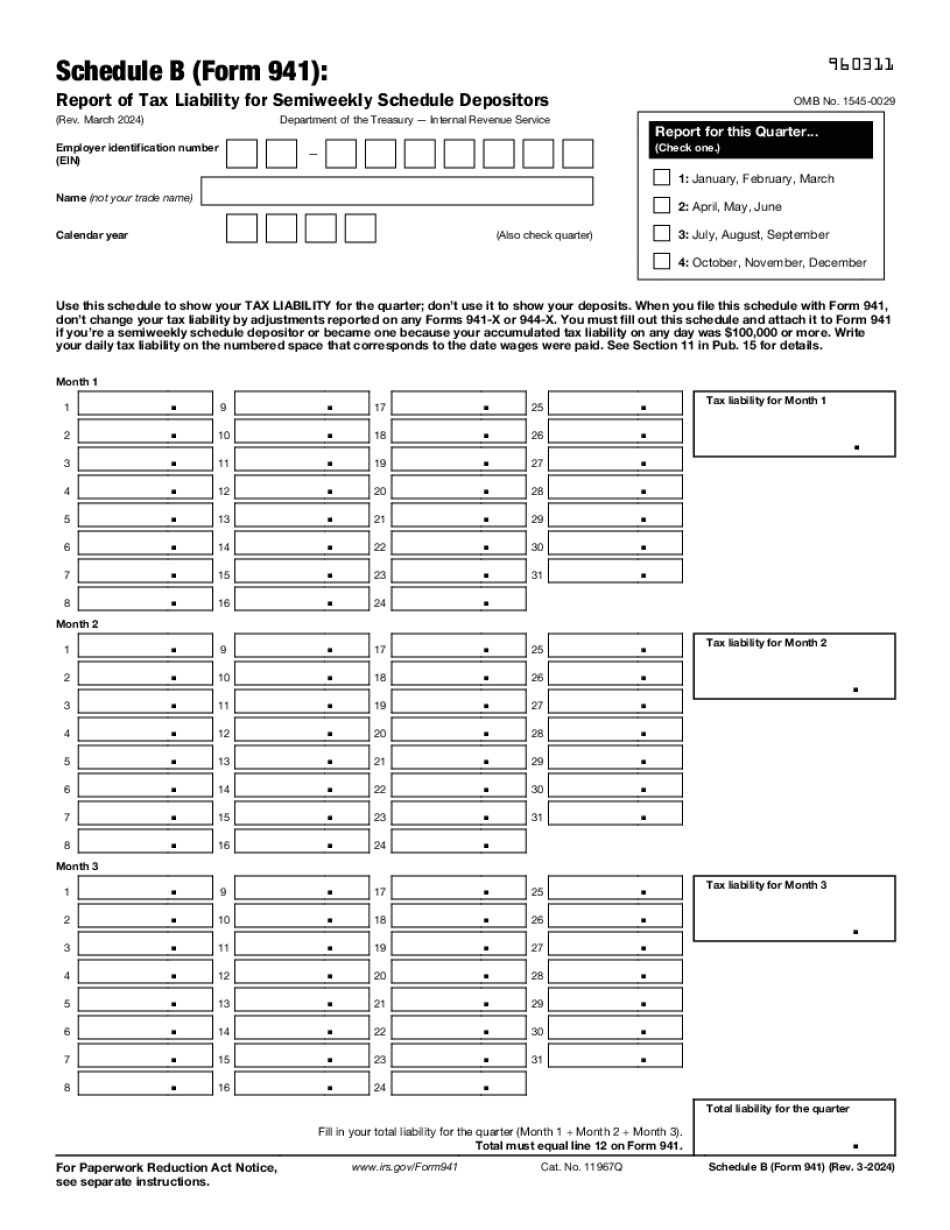

Form 941 (Schedule B) Wilmington North Carolina: What You Should Know

Forms are due on or before the 1st day of the 2nd month after the tax year begins. IRS Announces Final Guidance on Personal Exemption Sep 01, 2560 BE — The IRS announced final guidance for the personal exemption, finalizing previously issued guidance on tax-exempt education benefits and tax-exempt military pay and allowances. (PDF) Sep 01, 2556 BE — As the filing deadline draws nearer, the IRS and North Carolina Department of Revenue have agreed on an updated list of tax-exempt educational benefits and the filing dates for these benefits. IRS Releases Personal Exemption Guidance for 2025 Filing Month Jul 05, 2539 BE — The IRS has released final guidelines on the application of the personal exemption on the return for the 2025 tax year. IRS Issues New Rule to Clarify Personal Exemption Payments Oct 31, 2487 BE — The IRS issued a “rule” to clarify the rules on qualifying for tax-exempt education benefits. The new rules, announced September 8, 2017, would provide more clarity and uniformity in the rules for how a taxpayer qualifies for a tax-exempt benefit. The proposed rule provides that an educational benefit for which a qualified educational institution is responsible for payment of qualified education expenses will be considered a personal exemption payment when the qualified education expenses are paid by a financial institution. IRS Announces Final Personal Exemption Guidance for 2025 Filing Month Jul 05, 2539 BE — The IRS has released final guidelines for qualifying for the personal exemption on the return for the 2025 tax year. (PDF) IRS Releases Final Guidance on Certain Tax-Exempt Employee Benefits for 2025 Filing Month Jun 30, 2545 BE — The IRS has released final guidance on the application of the personal exemption, finalizing previously issued guidance on tax-exempt education benefits and tax-exempt military pay and allowances. (PDF) IRS Announces Final Guidance for Tax-Exempt Military Pay and Allowances, 2025 Filing Month Nov 30, 2545 BE — The IRS has announced the final rule for tax exemptions of employee group health insurance benefits. This will be effective October 1, 2017. The final guidance clarifies a provision of the IRS regulations for reporting and paying over a tax-exempt group health insurance benefit on a tax return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941 (Schedule B) Wilmington North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941 (Schedule B) Wilmington North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941 (Schedule B) Wilmington North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941 (Schedule B) Wilmington North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.