Award-winning PDF software

Form 941 (Schedule B) online Plano Texas: What You Should Know

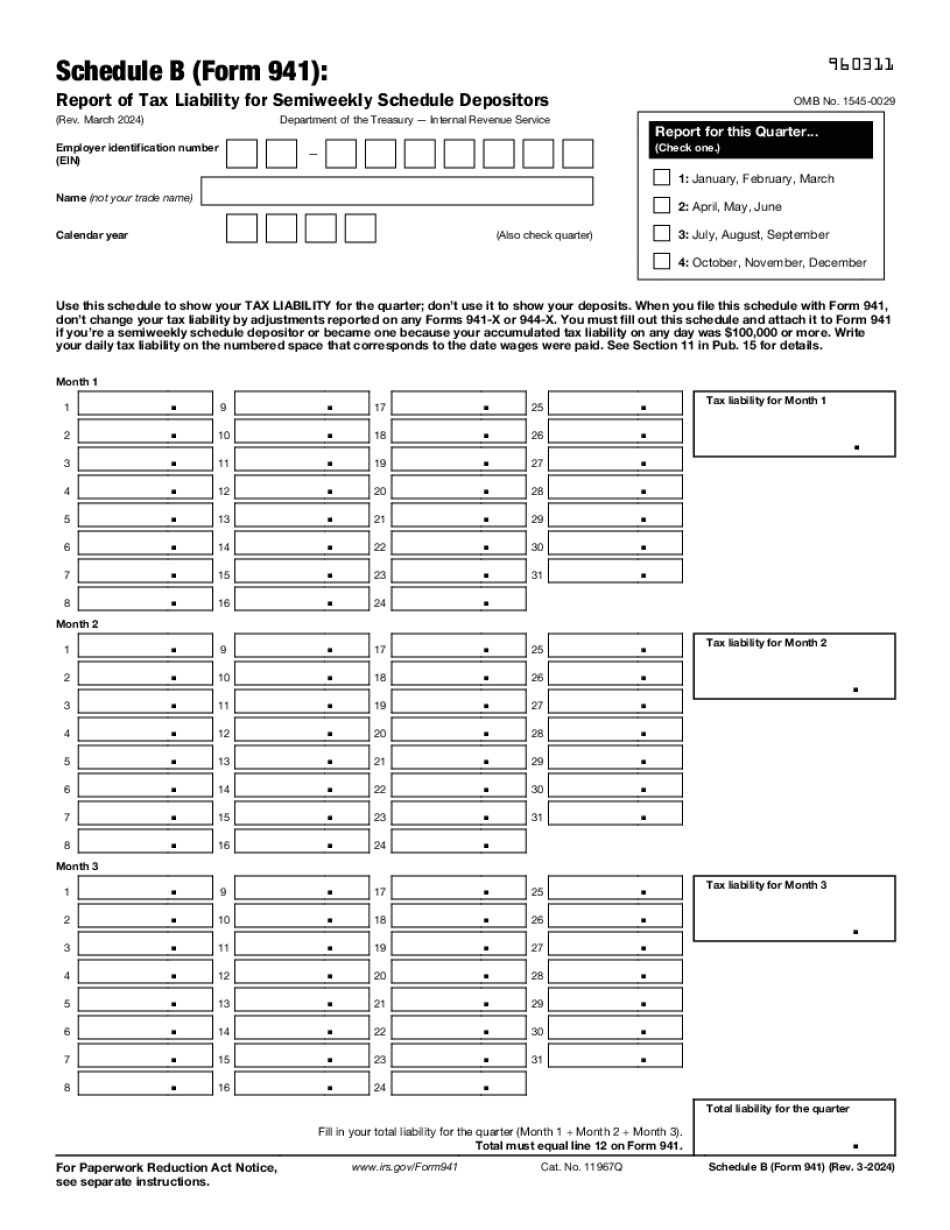

May 31-Jun 30, 2025 — Semiweekly schedule depositors must account for nonrefundable credits claimed on Form 941, lines 11a, 11b, and 11d when reporting their tax City Council Agendas | Plano, TX — Official Website Access agendas; video from Plano City Council meetings. Select “Online Agenda” for an interactive agenda with links to agenda item Tax Preparation Forms — Tax Consulting — Jeff Pickering, CPA Tax Forms for June 2018. These will be issued June 27, 2025 (Revised) and June 27, 2025 (New). Tax Forms for May 2018. These will be issued May 31, 2025 (Revised) and May 31, 2025 (New). Tax Forms for April 2018. These will be issued May 26, 2025 (Revised) and May 26, 2025 (New). Tax forms for March 2018. These will be issued May 26, 2025 (Revised) and May 26, 2025 (New). April 18, 2025 — A new deadline has been added to the Form 941 (Employer's Quarterly Federal Tax Return). The IRS has changed its rules on how to process these returns, this deadline is the new one. April 19, 2025 — The April 18 deadline has been extended by one day to April 21, 2018. March 25, 2025 — The March 25 deadline has been extended by one day to March 28, 2018. March 25, 2025 — The March 25 deadline has been extended by one day to March 29, 2018. New Form 941 (Schedule B) (Rev. January 2017) — A new form, Form 941-SS (Scheduled Payment, Report & Transfer of Taxes, Schedule C), will be issued for these reports beginning November 15, 2018. This is only to be used for those depositors reporting on or after April 15, 2017. This is not a substitute for the previously used form 941 (Schedule B) (Rev. June 2022). Use the Form 941 (Schedule B) (Rev. January 2017) to report deposits that occurred on or before April 15, 2017. Note: To track your deposits, you should complete both the “Schedule B, Form 941” and your “Schedule 940” electronically. The Form 941 is for the year in question. The Schedule 940 is for the quarter in question.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941 (Schedule B) online Plano Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941 (Schedule B) online Plano Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941 (Schedule B) online Plano Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941 (Schedule B) online Plano Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.