Award-winning PDF software

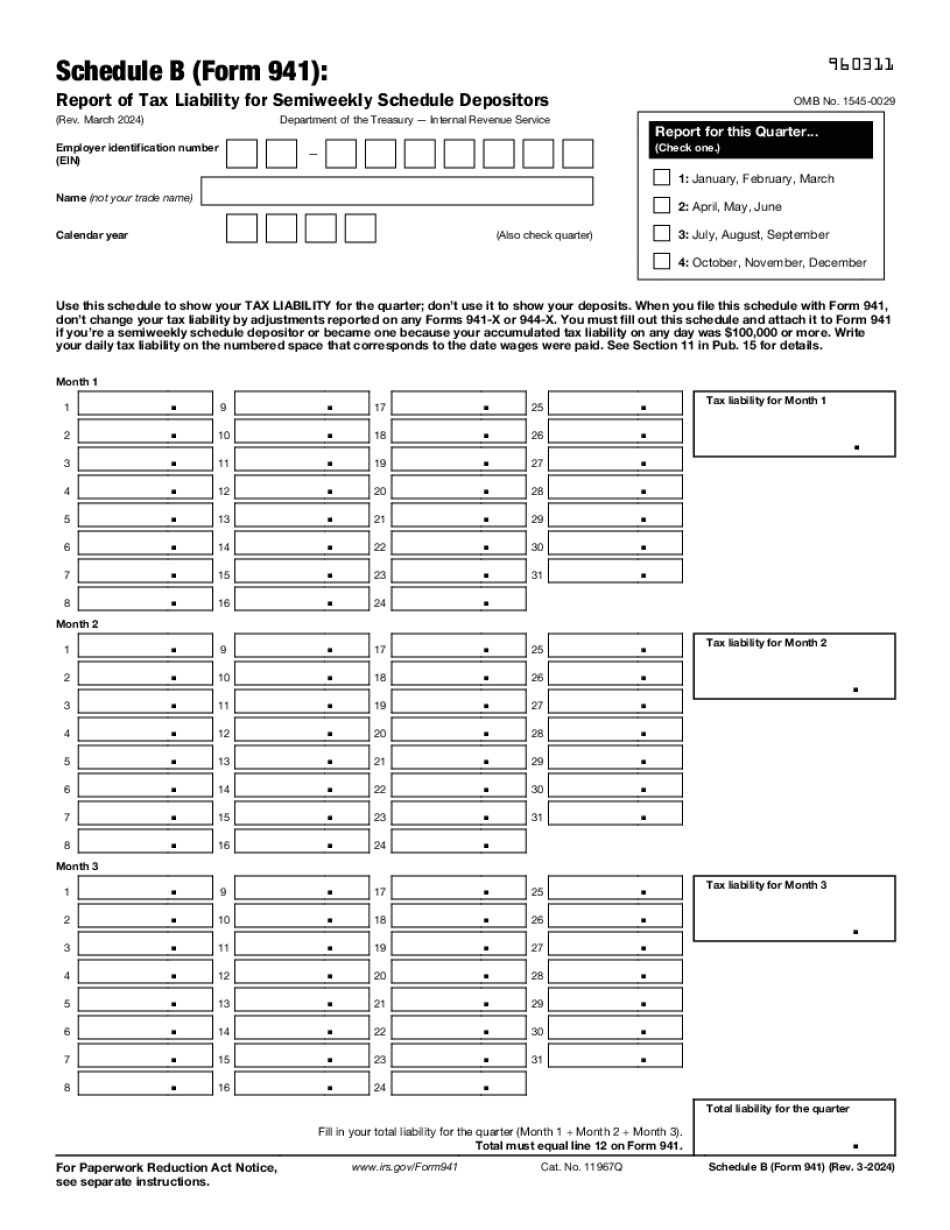

Abilene Texas Form 941 (Schedule B): What You Should Know

Texas. Gov If you would like access to this website's resources on tax advice for employment tax and retirement income taxes, call us at the number provided below. Tax Counsel. Texas. Gov This office provides tax advice to persons, businesses, and organizations who pay Texas employment taxes. For example, this office can assist with employment tax compliance, employer reporting requirements, tax shelters, self-employment tax, and state benefits tax. Texas. Gov You can call extension 1424 or email taxservicestoledo.Texas.gov You can call extension 1208, or email taxservicestoledo.Texas.gov Toll Free: TTY Toll Free: Texas Tax Commission This office is responsible for processing and determining whether individuals and companies in Texas are required to pay the corporate income tax and self-employment tax. The office collects, assesses, and collects the employee and independent contractor corporate income tax. The office also provides tax advice to individuals and businesses who pay the self-employment tax. The office assesses and collects the tax for both the employer and the independent contractor. The office also assists employers and independent contractors interested in developing tax policies. The state has the largest state employee payroll system in the country, with more than 15 million employees. The state pays the majority of the salaries of its employees by collecting, assessing, and collecting the corporate income tax. The state is the only state in the nation that collects all corporate income taxes. State employees are required to be paid at least 4.5 percent of federal minimum wage and the state allows employers to deduct the cost of benefits in computing employees' wages and fringe benefits. State workers can choose to be paid on commission or at a flat rate. Employers can choose to be paid on commission or at a flat rate. Mistake #8: Payroll tax payments are overdue. If you make more than 30 payroll tax payments with a due date between your pay period's 14th day and 31st, you're overdue and should file a return with the IRS. You shouldn't miss another payment when you get a paycheck from your employer. Mistake #9: Payroll tax returns were mailed to the wrong address.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Abilene Texas Form 941 (Schedule B), keep away from glitches and furnish it inside a timely method:

How to complete a Abilene Texas Form 941 (Schedule B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Abilene Texas Form 941 (Schedule B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Abilene Texas Form 941 (Schedule B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.