In this presentation, we will take a look at our payroll forms after running payroll, including a 401k plan within QuickBooks. For more accounting information and accounting courses, please visit our website at accountinginstruction.info. We are currently on the home page and have the open windows open. To view the open windows, go to the view drop-down and select open windows lists. Let's now proceed to review our reports and then examine our forms - W2, W3, and 941 - to understand how they differ. To access the reports dropdown, navigate to company and financial. Let's start by looking at the balance sheet standard. Set the date range from 101 to 1018. Once done, review the balance sheet and pay close attention to the paychecks processed and payroll liabilities. Although we'll delve deeper into these financial statements later, it's important to highlight them as they are crucial for comprehensive financial analysis. Now, go back to the reports dropdown, select company and financial, and click on the profit and loss report. Adjust the date range to 101 to 1231 to view the payroll grouped together, including payroll taxes and gross pay. As the income statement shows, there is currently no other income since we have only processed the payroll. Let's proceed to run the payroll forms to see how they appear. Navigate to the employees dropdown, select payroll tax forms, and process the 940 and w2/w3 forms to assess the impact of the two payrolls we have processed. First, let's review the 941 form. Click on it to create or double-click to open it. Set the quarter end date to 33118, indicating the first quarter. After confirming the details, we will be presented with the payroll processing form. Skipping the interview process, let's examine the calculations made thus far. Note that...

Award-winning PDF software

2024 941 instructions Form: What You Should Know

You may not use Forms W-2 or Schedule D-TR to report Wisconsin income tax withholding. For information on Wisconsin income tax withholding, see The Wisconsin Income Tax Withholding Code. F1 Include the amount of any state income taxes for the year to which your payment is attributable. F2 Enter the number of the individual or partnership who will receive the income F3 Enter the number of the individual and the amount for whom the individual is responsible under federal law. F4 Enter the gross income as reported on your most recent Form W-2. F5 Enter the amount the individual made from an unrelated trade or business in the most recent 3 months. F6 Enter the amount the individual made from an unrelated trade or business in the most recent 2 years (or) the last 3 years that the individual has been receiving payment. F7 Enter the amount the individual made from related trade or business. F8 Enter the amount the individual made from an unrelated trade or business on an IRA. F9 Complete a statement to see if you qualify to claim the credit. F10 Complete a statement for each unrelated trade or business you controlled and which you reported on Form 8886. For additional information, see the instructions for Form 8886. F11 Complete a statement to see if you qualify for the credit. F12 Enter the amount of the credit for income taxes paid to any other state or United States for you, your spouse, or your dependent for the tax year. F13 Enter the credit applied to state or local income taxes for other residents of the Illinois or US territory. F14 Complete a statement showing the amount of federal income tax withheld, which will be shown elsewhere on your return, but will not affect your filing status. F15 Complete a statement showing the amount of non-employer withheld Illinois income tax, which will not affect your filing status. F16 Enter your Illinois Social Security number. I1 Include all interest income for the year. II2 Include all rental real estate income for the year. III Enter any income you received from employment as an individual or partnership for the year. Go to, Form 941-A, and other forms, to find more information. Form 941 (Rev. January 2019) — IRS. You may use Form 941 to file tax returns for individuals, partnerships, and other tax-exempt organizations.

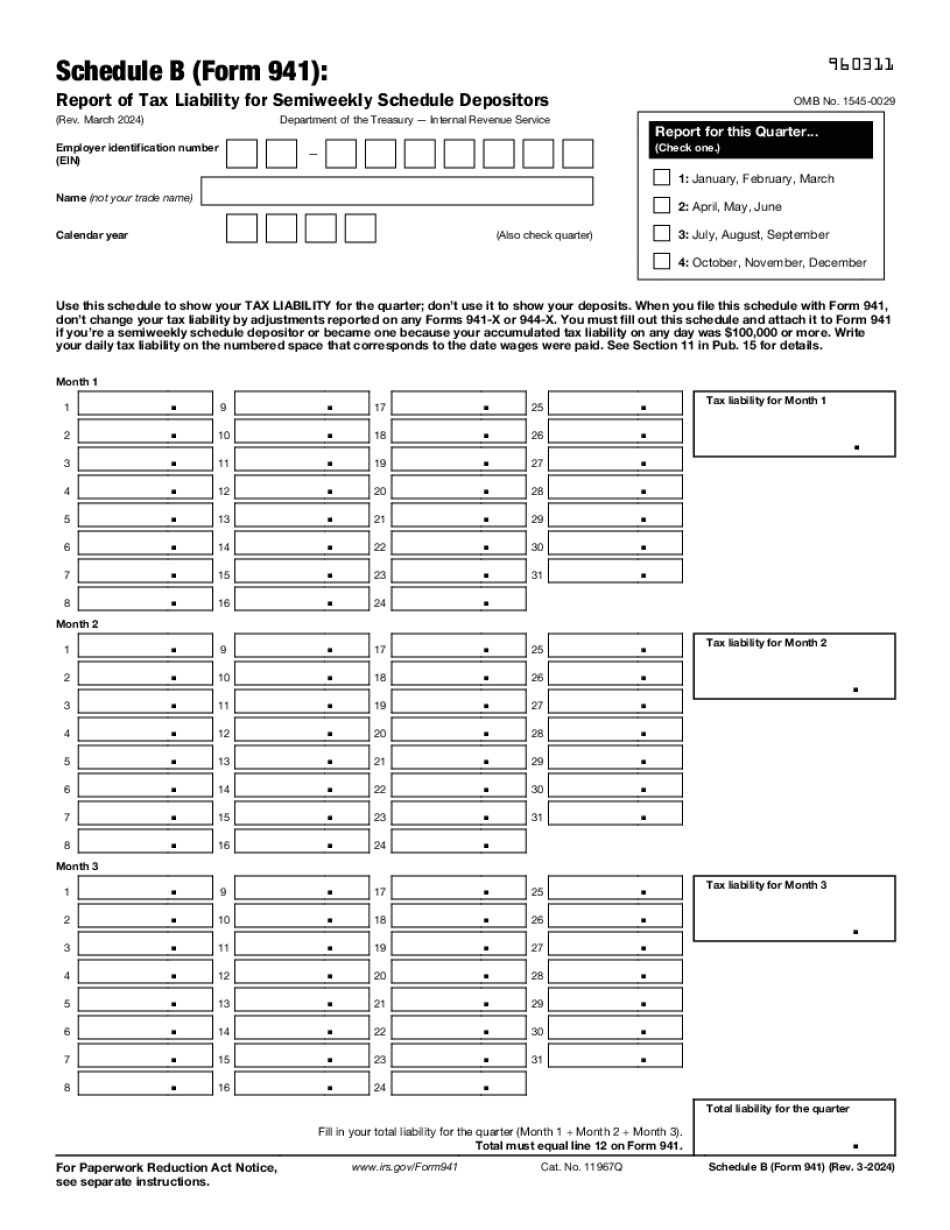

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 941 (Schedule B), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 941 (Schedule B) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 941 (Schedule B) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 941 (Schedule B) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 form 941 instructions